Security systems for Bankomat play an essential role in securing financial transactions as well as personal details of those who use automated machine for teller (ATMs). As technology advances at a rapid pace the security systems are continually evolving to address the ever-changing issues posed by advanced cyber-attacks and attempts to steal. This article will explore the latest technological advances in banking security systems, and shed the light on the technological advancements that have transformed the field. In addition to biometric security, AI-powered fraud prevention enhanced encryption, and incorporation with IoT or cloud computing we’ll explore the latest technologies that are changing the face for secure banking. Through understanding these developments we will gain insight into the strategies being implemented to protect the integrity and security of financial transactions, and strengthen the trust that people put in the security of bankomat.cm systems.

1. An Introduction Bankomat Security Systems

1.1 What is Bankomat Security Systems?

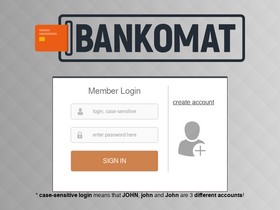

Bankomat Security Systems are the security measures put in place to safeguard as well as secure ATMs (ATMs). These systems are designed to guarantee the integrity, confidentiality and availability of ATM services, while preventing fraudulent access, unauthorized access, and other security violations.

1.2 The importance of Bankomat Security Systems

With the growing dependence on ATMs to conduct everyday bank transactions, the significance to Bankomat Security Systems cannot be overstated. They are vital to maintaining trust and confidence of the customer within the banking system and in protecting their assets and financial accounts. These systems block unauthorised access to accounts of customers and safeguard against card skimming and the cloning of accounts, and identify fraudulent activity, ultimately guaranteeing the security of customers as well as the banks.

1.3 The most important components of Bankomat Security Systems

Bankomat Security Systems comprise various components that work together to form an efficient security framework. These components usually include encrypted hardware, secure hardware as well as access control mechanisms, surveillance systems intruder detection system. Each one plays a vital function in ensuring the security and reliability that is the ATM infrastructure.

2. Development of Bankomat Security Systems

2.1 Early Security Strategies in Bankomat Systems

In the beginning of ATMs security measures mostly focused on physical security including elaborate vaults and safe enclosures. These measures were intended to stop theft and unauthorized access to cash within the ATMs. As technology improved and new security threats emerged that required more sophisticated security systems.

2.2 Improvements of Bankomat Security Systems over the decades

The advancements in technology have changed the way we use Bankomat Security Systems. In the introduction of PIN (Personal Identification Number) authentication was a major achievement, adding an additional layer of protection to ATM transactions. The implementation of encryption algorithms and secure communication protocols also increased the security of the transmission of data between ATMs and banks. In addition, advances in the computer hardware and software enabled greater surveillance capabilities and detection of fraud systems.

2.3 The impact of technological innovations upon Bankomat Security Systems

Technology innovations have had an enormous influence in Bankomat Security Systems, revolutionizing the method by which ATM security is addressed. The use of machine-learning algorithmic techniques and AI has allowed ATM systems to be able to learn and adapt to new security threats in real-time. Data analytics improvements can also improve the detection and prevention of fraud which has reduced the financial burden for banks and their customers.

3. New technological advances for Bankomat Security Systems

3.1 Introduction to the Latest technological advancements

The past few years have seen remarkable technological advancements within Bankomat Security Systems. This includes the use of biometric authentication techniques like facial recognition and fingerprint recognition, to improve the security and ease in ATM transactions. The latest ATM card readers as well as tamper-proof keypads are also being introduced to protect against card skimming and reduce the chance of losing your PIN.

3.2 Enhanced Methods for Authentication

One of the most notable developments of bankomat ssn Security Systems is the utilization of advanced authentication methods. Biometric authentication, specifically is an additional secure and reliable way of confirming a client’s identity when using ATMs. With the help of unique biological traits like the iris pattern or fingerprints banks can make sure that only authorized people are able to access their accounts. This is an added layer of security against theft of cards or fake PINs.

3.3 Better surveillance and detection of fraud

The technology for fraud detection and surveillance have also been improved dramatically. Advanced surveillance systems using high-resolution cameras and smart analytics are able to detect suspicious activity near ATMs in real time. This allows quick response to security threats that could be a threat and can help stop fraudulent transactions. Machine learning algorithms can analyse the patterns of transactions and spot irregularities, which allows for an early detection of fraudulent activity.

4. Biometric authentication in Bankomat Security Systems

4.1 A Brief Introduction Biometric Authentication

Biometric authentication is the use of distinctive physical or behavioral features to confirm the identity of a person. Within Bankomat Security Systems, biometric authentication methods, like fingerprint recognition, fingerprint scanning as well as facial recognition are used to provide secure and easy access to ATM services.

4.2 Different types of Biometric authentication in Bankomat Systems

Bankomat Security Systems utilize various biometric authentication methods. Fingerprint recognition, which is where fingerprints of the user are scanned and then compared to a previously stored template, is popular due to its reliability and user-friendliness. The technology of facial recognition that analyses facial features to determine authenticity, is also growing in popularity. Furthermore, iris recognition as well as voice recognition are among the latest biometric authentication techniques being studied for ATMs.

4.3 Benefits and Drawbacks of Biometric authentication

Biometric authentication provides a variety of advantages to Bankomat Security Systems. It gives a greater level of security than traditional methods such as passwords or PINs because biometric authentication features are specific to each individual and are difficult to create. Biometric authentication can also increase convenience for ATM users by eliminating the necessity to remember or carry cards as well as the need to remember PINs. However biometric authentication systems can have issues with security, accuracy and the potential for frauds that spoof the user’s identity. The ongoing research and development efforts in this area aim to overcome these weaknesses and to ensure the continuous improvement of user-friendly and secure Bankomat Security Systems.

5. Artificial Intelligence and Machine Learning in Bankomat Security Systems

5.1 The role in the use of AI as well as Machine Learning in Bankomat Security

In the field of security and protection, technologies are always developing. Some of the hottest developments of banking (ATM) security is incorporation with Artificial Intelligence (AI) as well as machine-learning. Machine learning and AI are crucial to improving the security of bankomats by studying large amounts of data, and discovering patterns that could suggest fraudulent activities.

5.2 AI-driven fraud detection and prevention

There is no longer a time when bankomat security was solely based on the outdated security measures. With the help of AI and machine learning banksomat systems are now equipped with sophisticated protection against fraud and detection capabilities. These systems have been trained to detect unusual transactions, identify the possibility of card skimmers and card tampering, and also identify suspicious activity by studying the data in real-time.

5.3 Application that make use of Machine Learning in Bankomat Security Systems

Machine learning applications in the security of bankomat systems are numerous. Starting with facial recognition technologies which validates the identity of users to algorithms that look at historical data to spot fraudulent transactions machine learning is changing security within the banking industry. These innovations not only safeguard the users from unauthorised access, but also provide a seamless user experience.

6. Secured Encryption and Data Protection within Bankomat Security Systems

6.1 The importance of encryption in Bankomat Systems

The encryption process is similar to the secret code that helps keep important data safe and secure. For security systems for banks encryption plays an important function in protecting sensitive information like PIN numbers and account information. By encryption of data even in the incident of a security breach the stolen data is ineffective and useless to anyone who is not authorized.

6.2 Advanced Encryption Technologies

As technology improves and technology improves, so too does the need for stronger encryption technologies. Modern security systems for banks employ advanced encryption methods like Asymmetric encryption and secure key exchange protocols to ensure that information remains secure and private. These encryption techniques work in conjunction with artificial intelligence-powered fraud detection systems that provide several levels of protection.

6.3 Data Security Strategies included in Bankomat Security Systems

Data security is a top priority for banks’ security systems. In addition to encryption, the systems use various security measures to guard personal information of the users. These include strict access controls and regular security audits and the adherence to industry-leading methods. Through the implementation of comprehensive data security measures, security systems for banks give users confidence that their personal information is secure in the hands of a trusted company.

7. The integration of IoT and Cloud Computing in Bankomat Security Systems

7.1 Utilizing IoT to Boost Security

The Internet of Things (IoT) is now integrated into the security systems of banks and has boosted security measures. IoT-connected devices, such as cameras and sensors have been strategically placed in order to watch the environment around bankomat machines. They are linked to the system and offer live data that allows AI algorithms to detect suspicious activity and prevent dangers.

7.2 Cloud Computing in Bankomat Security Systems

Cloud computing has revolutionized a number of industries, and security for banks is not a different case. Utilizing the power of cloud computing banksomat security systems are able to manage and store huge quantities of data in a secure manner. Cloud-based storage can be used to provide immediate updates and remote administration which makes it much easier to install security patches and system updates quickly.

7.3 Advantages and Challenges from IoT as well as Cloud Integration

The combination between IoT as well as cloud-based computing provides many benefits for security systems for banks. It allows for faster detection of threats and improves the scalability of systems and improves the overall user experience. But there are obstacles to be faced like protecting data privacy and reducing the threat of cyberattacks. But, with appropriate safety protocols the advantages of IoT and cloud integration surpass the possible challenges.

8. Future trends and challenges within Bankomat Security Systems

As technology advances and advance, the future of security systems for banks appears promising. However, advancements in technology also present new problems. One of the emerging trend is to use biometric verification methods, like fingerprint or iris scanning to increase security and improve convenience. Furthermore, the growth of digital wallets and mobile banking creates new challenges for banksomat security systems to adjust and change to meet evolving requirements of the users. The key is striking an equilibrium between security and user-friendliness making sure that bankomat systems remain secure, without compromising user experience.In conclusion, the constant technological advances in security systems for banks have dramatically improved the security and security of people’s financial transactions. With biometric security to machine learning and artificial intelligence they are developing to stay ahead of threats and fraud attempts. Through the integrated use of IoT with cloud computing the future of the bankomat security system is looking promising, with improved efficiency and robust security. As we progress it is essential that financial institutions remain alert and proactive when it comes to adopting these advances to ensure the best safety for the customers they serve. Through continuous research and development, bankomat’s security systems continue to play an essential function in providing a secure banking experience for everyone.

FAQ

1. What security measures do banksomat systems help to guard against the possibility of fraud?

bankomat security systems use a variety of methods to safeguard against fraudulent activities. They employ advanced authentication methods like biometric identification, sophisticated encryption algorithms to protect data transmission and AI-driven fraud detection systems that detect suspicious activity in real-time. These systems constantly check transactions and employ algorithms that learn to identify and block fraudulent activities.

2. Are security systems for banks vulnerable to hackers?

Although no system is completely secure from hacking, bankomat security systems use various layers of security measures to limit vulnerability. They include robust encryption protocols, frequent security updates, and continuous surveillance for suspicious activity. Financial institutions also collaborate with cybersecurity experts to discover and fix any vulnerabilities that could be present to keep ahead of new threats.

3. What are the benefits of integrating IoT with cloud computing improve the security of bankomat systems?

The combination between IoT with cloud computing provides many advantages to the bankomat security system. IoT devices allow 24/7 monitoring of ATMs and also provide improved capabilities for remote management. Cloud computing allows for central data storage and analysis, and rapid deployment of security updates across ATMs. This integration improves the capacity, efficiency and speed of security systems for bankomats and improves their efficiency in protecting financial transactions.

4. What can people take to guarantee their security in using a bankomat?

Although banks have sophisticated security measures in place however, people can take certain measures to protect themselves. This includes securing their PINs, staying aware of their surroundings when making use of ATMs, not using ATMs in dark or isolated locations, and frequently checking their bank statements for any suspicious transactions. It is also advised that you report suspicious transactions or irregularities to the bank immediately.